The third quarter of 2024 has been marked by the wait for election results in the United States, which kept the markets in a cautious mood for much of the period. In recent weeks, following the results, we have seen a positive reaction from investors, who have celebrated the end of political uncertainty. This relief has translated into greater stability in financial markets and renewed optimism about the economic outlook.

Attention now turns to how the new Trump administration will implement its campaign promises, especially those related to tax and trade policies. These measures, together with a still complex geopolitical environment and the evolution of central bank decisions, will be decisive for market dynamics in the coming months.

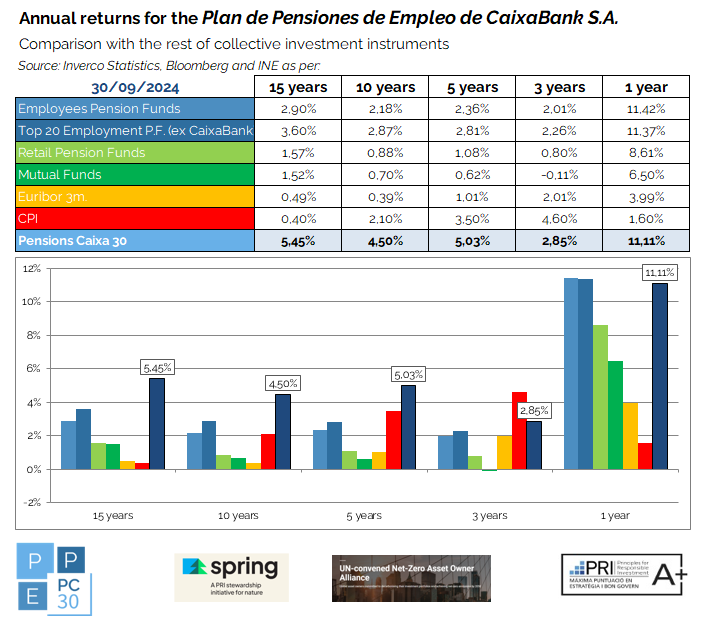

In terms of yield, the fund’s five-year return stands at 5.03%, well above the fund’s investment objective (EUR3M + 2.75%), which for the period stands at 3.85%. This result underscores the strength of the PC30 and its ability to deliver consistent value to unitholders, even in a challenging economic and political environment.

Below is a comparison of the performance of different investment instruments in the third quarter of 2024.