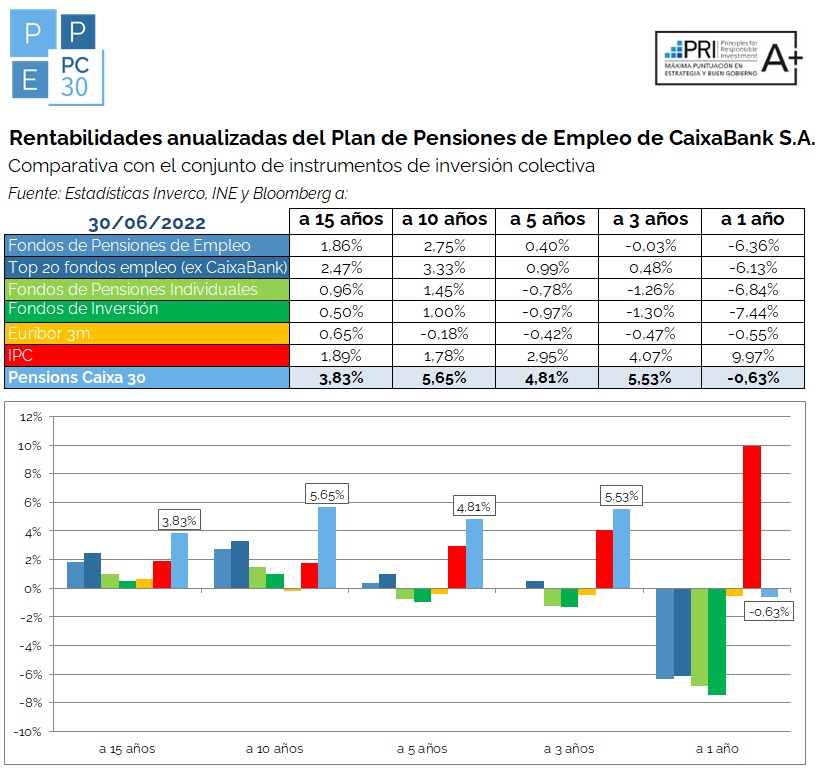

Comportamiento de diferentes instrumentos de inversión a junio de 2022

The profitability data of different investment instruments at the end of the first quarter of 2022 have been made public, which allows us to frame the results of PC30.

Employment Pension Plans continue to be the long-term investment instrument that performs best in all the periods studied, although, in this unfavorable macroeconomic context, this better performance means having a less negative return. We can see again as their long-term focus and their illiquid nature makes them more resilient.

We continue in a complicated macroeconomic environment: from the inflation/growth binomi, central banks are giving priority to controlling inflation, thus maintaining the upward environment in terms of rates despite the risks of recession. Geopolitical uncertainty remains due to the Russia-Ukraine conflict and the energy crisis it has caused adds to the headwinds that we will face in this second part of the year.

Interest rates (Euribor 3m, the index on which the 5-year investment target is calculated), still do not fully reflect this new situation, so the PC30 continues to largely meet its investment target. Inflation and the fall in risk assets are punishing purchasing power in the short term, although real returns, after inflation, have remained positive since year 3.