Returns on different investment instruments in 2021

The profitability data of different investment instruments at the end of 2021 have been published so we can contextualize the results of PC30. First thing to highlight, is that employment pension plans have become the long-term investment instrument that performs best in all the periods studied. The time horizon of their mandates allows them to better resist bearish market movements, making it easier for them to seize the risk premium on assets such as equities or private fixed income. Likewise, their illiquid nature means that they can access illiquid instruments that, for the same reason, pay extra returns compared to more conventional assets.

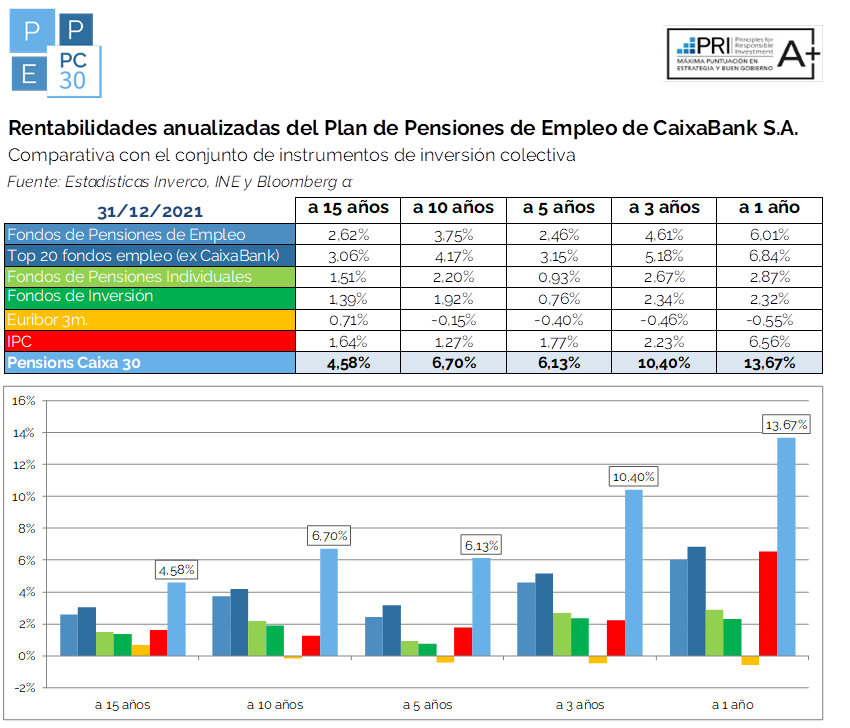

The next graph compares the historical returns of different savings instruments with the investment profile of the PC30. It also shows the levels of the 3-month Euribor, the index on which the 5-year investment objective is calculated, and the value of inflation, so we can have a visual sense of the purchasing value of our investment. On the one hand, we can see how the high inflation of 2021 has had a significant impact on the profitability of many investment instruments, that have become negative in real terms. On the other hand, we see that interest rates, Euribor 3m, have not yet picked up this rise in prices, so the PC30 continues to beat its investment objective.