Carbon Footprint 2019

The Carbon Footprint of Pensions Caixa 30, F.P. (hereinafter PC30) in 2019(in terms of intensity, a metric that weights the emission of greenhouse gases by the sales of the companies that make up the benchmark index) was 185 tCO2e/M$.

Compared to 2018, the reading was 30% lower.

Carbon dioxide equivalent (CO2e) is a measure used internationally to show the effect of individual greenhouse gases.

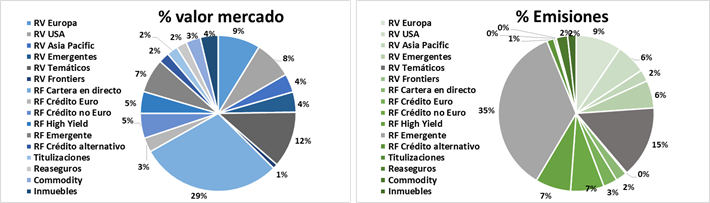

Portfolio weight of total issuance

More than 50% of issuance is concentrated in two asset classes, Emerging Fixed Income (35%) and Thematic Equities (15%). Does not include the private equity portfolio.

What is the carbon footprint?

The carbon footprint is a metric for assessing the amount of greenhouse gas emissions attributable to a product, service, process or organisation.

In the specific case of PC30, it corresponds to the amount of greenhouse gases emitted by the set of stocks that make up the equity portfolio of the Pension Fund.

The Montreal Carbon Pledge

It is an initiative that promotes the measurement of the carbon footprint in the portfolios of those investors who decide to take part in it.

The initiative was launched on 25 September 2014 in Montreal with the backing of the UN Principles for Responsible Investment (PRI), with the aim of enabling a better understanding of the risks and opportunities that climate change brings to the industry, as well as having the commitment of $3 trillion of funds pledged for climate change mitigation and adaptation. United Nations Climate Change Conference in December 2015 in Paris (COP21). It succeeded in reaching a global agreement to reduce greenhouse gas emissions.

By signing the Montreal Commitment, investors commit (annually) to measure and publicly disclose the carbon footprint of their portfolios.

The initiative currently has more than 120 signatories from North America, Europe and Asia Pacific with combined assets in excess of $10 billion (including PGGM, Calpers, Railpen and VicSuper).

Why is it important?

The Global Risks Report published in 2016 by the World Economic Forum identifies climate change as the risk with the greatest potential economic impact. Since the report was first published in 2006, this is the first time that an environmental risk has topped this ranking.

As a consequence of the increased relevance of this problem, institutional investors globally are working to address this new challenge through organisations such as the Institutional Investors Group on Climate Change, initiatives such as the Montreal Carbon Commitmentor the signing of the United Nations Principles for Responsible Investment (PRI).

Why is it important for PC30?

As a signatory to the PRIs, environmental, social and governance (ESG) issues are incorporated into the investment process of our Pension Fund. Therefore, having a metric that allows us to determine the environmental impact of our investments helps us to assess our portfolio against the ESG commitments we have made as signatories to the PRIs.

Climate change is both a risk and an opportunity for long-term investors such as PC30. Measuring the carbon footprint of our fund allows us to have a better understanding of the potential environmental impact of our portfolio.

You can consult the publications of previous years in the following links:

2015 Carbon Footprint Measurement PC30

2016 Carbon Footprint Measurement PC30

2017 Carbon Footprint Measurement PC30

2018 Carbon Footprint Measurement PC30

PC30 and CaixaBank’s Employment Pension Plan Control Committee.

Barcelona, July 2020.