Investment instruments performance in the first quarter of 2022

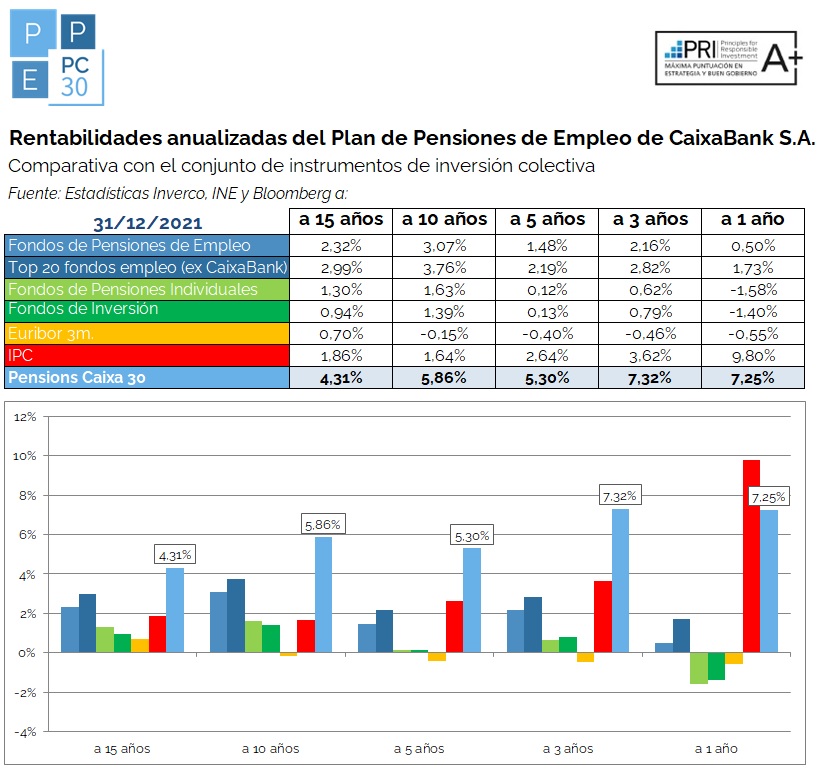

The profitability data of different investment instruments at the end of the first quarter of 2022 have been made public, which allows us to frame the results of PC30.

Employment Pension Plans continue to be the long-term investment instrument that performs best in all the periods studied. Given their illiquid nature, which allows them to access illiquid assets with higher returns, and the long-term temporary focus of their mandates, which allows them not to respond reactively to specific market shocks, pension funds are especially resilient to downturns.

And that is precisely the type of macroeconomic environment that we are experiencing in these first months of 2022: an environment of rising inflation and rising rates with geopolitical uncertainty due to the Russia-Ukraine conflict. All this is punishing risk assets at the beginning of 2022; we do not know for how long.

Interest rates (Euribor 3m, the index on which the 5-year investment target is calculated), have not fully reflected this new situation, so the PC30 continues to largely meet its investment target. Inflation is punishing purchasing power in the short term, although real profitability, once inflation has been discounted, has remained positive since 3 years.