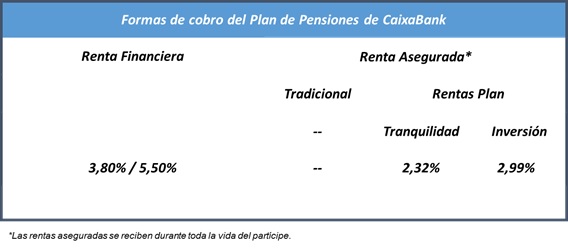

In an interest rate environment such as the current one, some of the payment methods that the CaixaBank Pension Plan offers to its shareholders are sometimes inapplicable. This is the case, for example, of different types of annuities. Depending on the circumstances, the combination of the expected term of the annuity with the level of interest rates offered by the assets that would make it possible to secure such an annuity does not allow such an offer to be made. The performance of PC30 throughout its history, as can be seen in the information we publish monthly, has offered a long-term return that has allowed participants who have chosen the type of financial income that fits the objectives of the Fund (Euribor at 3M + 2,75%) to receive an income. However, for those who prefer an option that removes uncertainty about the timing of their future income, at the cost of a possible higher return, the current environment has left them with no options.

To meet this demand, the CaixaBank Employees’ Pension Plan has been offering a new form of payment since 14 October 2020. This form, called Plan Annuities, offers the option of receiving an insured income with the additional possibility that, at the time the benefit ceases, the designated beneficiaries will receive a capital sum associated with a portfolio of financial assets. It is therefore a hybrid product in which part of the investment is intended to guarantee an annuity while the other part, the managed portfolio, is intended to maximise the market value of the assets in which it invests. There are two variants: one with a higher insured income and a smaller managed portfolio (and therefore a lower potential value at maturity) and one with a lower income and a larger managed portfolio. The first variant is called Rentas Plan Tranquilidad and the second variant Rentas Plan Inversión.

Like all insured annuities, this form of payment is implemented through a policy. The assets of the two portfolios, the hedging and investment portfolios, are selected according to VidaCaixa’s single criteria, unlike the Pension Fund, which is mainly investment in nature and is governed by the mandate of the Control Committee. However, the Plan receives regular information on the composition of the investment portfolio.

By way of illustration, on 28 October 2020, an Rentas Plan Tranquilitat for a 65 year old person would offer an income of 2,32% and would allow 100% recovery on the managed portfolio in 30 years, assuming an expected gross return of 5,50% on the portfolio. On the other hand, the annual return of the Fund over the last 20 years would be equivalent to receiving a 30-year income of 3,80% and recovering 100% of the capital or an income of 5,50% (assuming that 3,80% return) if the capital at the end of those 30 years was zero. Obviously, in the case of the insured income, this would be received while the insured person is still alive and, therefore, in addition to the difference in yields, it must be taken into account that the first option involves a lower level of uncertainty.

For more information on this new payment method or any of the existing ones, please contact the participant’s office at [email protected].